New 85% LTV BTL Mortgage: Foundation Boosts Competition for Landlords

More power to landlords! 85% LTV BTL mortgage entry brings fresh competition to existing offering.

For over a year, Vida Bank has stood alone as the sole provider of 85% loan-to-value (LTV) mortgages for Buy-to-Let Landlords.

This week, however, Foundation has joined the fray, introducing much-needed competition that could benefit landlords seeking higher leverage. This entry is a welcome addition to the market, expanding options for property investors.

Both lenders now offer products tailored to individuals and limited companies, with minimum loan sizes of £50,000 for Vida and £100,000 for Foundation. The maximum loan size caps at £500,000 for each.

When comparing the two, Vida provides a lower mortgage rate but includes a percentage-based loan fee. In contrast, Foundation boasts zero application fees, though it comes with a higher interest rate. At first glance, this might make Foundation more appealing for larger loans, where the absence of fees could offset the elevated rate. However, landlords should note a key caveat: Foundation's maximum borrowing is constrained by stress testing at a higher rate, which may limit the overall loan amount available.

It's also important to highlight that Foundation's new entry into this market is somewhat limited. Unlike Vida, which extends 85% LTV options to Houses in Multiple Occupation (HMOs) and Multi-Unit Freehold Blocks (MUFBs), Foundation does not currently cover these property types.

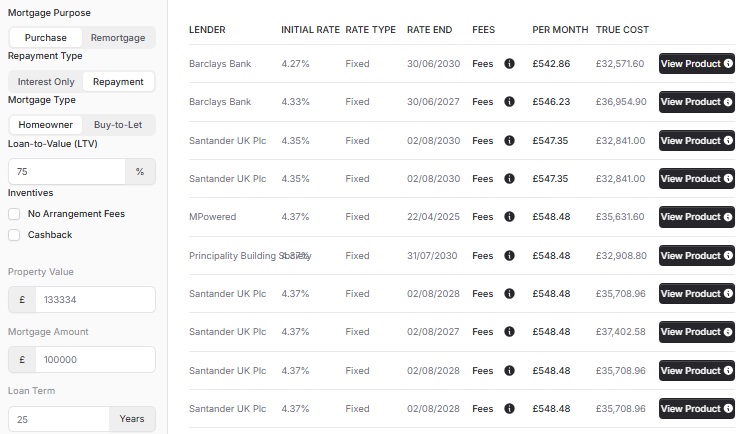

Lowest 85% LTV BTL Mortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

5.26%

2 Year Fixed

TBC

TBC

Fixed

at

5.26%

|

|

|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

5.94%

5 Year Fixed

TBC

TBC

Fixed

at

5.94%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

|

|

6.59%

5 Years Fixed

5

Years

Fixed

at

6.59%

|

|

The mortgage products shown are for illustrative purposes only and were generated 40 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.26%

2 Year Fixed

TBC

TBC

Fixed

at

5.26%

|

|

|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

5.94%

5 Year Fixed

TBC

TBC

Fixed

at

5.94%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

|

|

6.59%

5 Years Fixed

5

Years

Fixed

at

6.59%

|

|

The mortgage products shown are for illustrative purposes only and were generated 6 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.26%

2 Year Fixed

TBC

TBC

Fixed

at

5.26%

|

|

|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

5.94%

5 Year Fixed

TBC

TBC

Fixed

at

5.94%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

|

|

6.59%

5 Years Fixed

5

Years

Fixed

at

6.59%

|

|

The mortgage products shown are for illustrative purposes only and were generated 1 hour ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.26%

2 Year Fixed

TBC

TBC

Fixed

at

5.26%

|

|

|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

5.94%

5 Year Fixed

TBC

TBC

Fixed

at

5.94%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

|

|

6.59%

5 Years Fixed

5

Years

Fixed

at

6.59%

|

|

The mortgage products shown are for illustrative purposes only and were generated 6 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 49 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 42 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 6 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 6 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

Wondering if this could supercharge your portfolio? Let's break it down.

- Vida Pros: Lower rates, covers HMOs/MUFBs, smaller minimum loan.

- Vida Cons: Percentage-based fees.

- Foundation Pros: No fees, potentially better for large loans.

- Foundation Cons: Higher rates, stress testing limits, no HMOs/MUFBs.

Overall, this competition is a boon for the BTL sector, as more buy-to-let mortgages at 85% LTV offer more flexibility and potentially better deals depending on your specific needs. If you're a landlord considering remortgaging or making a new purchase, please get in touch.

85% LTV Mortgage Criteria

- Available for Houses in Multiple Occupation (HMOs)

- Available for Multi-Unit Blocks.

- Available for Standard Buy-to-Lets

- Available for Personal name OR Limited Company Buy to Let.

- Available in England, Wales, Scotland and Northern Ireland.

- No Minimum Income.

- Interest Only or Repayment.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX