HMO Remortgage

The best place to find Landlord HMO Remortgages simpler, clearer, faster

We can compare an HMO Product Transfer and HMO Remortgage for you to maximise your rental yield when you compare from some of the leading HMO mortgage providers in the UK with our nationwide mortgage specialists. Obtaining the best LTD Company HMO Mortgage for your circumstances.

Only a minority of Mortgage Lenders offer HMO Remortgages, a smaller minority offers Limited Company HMO Mortgages. Add in the rules around landlord finance from unusual properties, rental stress tests and more so for portfolio landlords.

Then your personal circumstances can limit options from minimum income, credit score and experience. A sensible property investor will seek advice from a specialist in HMO Mortgage Finance.

If you are looking to release equity from your HMO by remortgaging our advisers can look at Further Advance (from the current lender) and compare it to a remortgage, to get the best product for your circumstances.

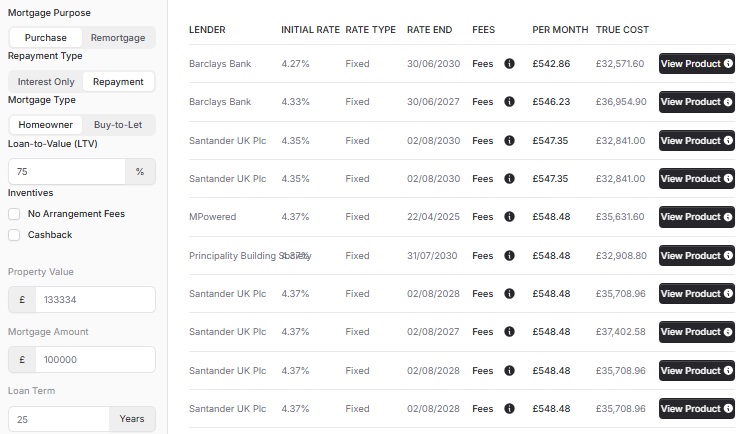

Lowest HMO Remortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

2.30%

2 Years Fixed

2

Years

Fixed

at

2.30%

|

|

|

|

2.35%

2 Years Fixed

2

Years

Fixed

at

2.35%

|

|

|

|

2.44%

2 Years Fixed

2

Years

Fixed

at

2.44%

|

|

|

|

2.45%

2 Years Fixed

2

Years

Fixed

at

2.45%

|

|

|

|

2.50%

2 Years Fixed

2

Years

Fixed

at

2.50%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £142858 property value, a £100000 loan amount and £42858 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

2.30%

2 Years Fixed

2

Years

Fixed

at

2.30%

|

|

|

|

2.35%

2 Years Fixed

2

Years

Fixed

at

2.35%

|

|

|

|

2.44%

2 Years Fixed

2

Years

Fixed

at

2.44%

|

|

|

|

2.45%

2 Years Fixed

2

Years

Fixed

at

2.45%

|

|

|

|

2.50%

2 Years Fixed

2

Years

Fixed

at

2.50%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £133334 property value, a £100000 loan amount and £33334 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

3.54%

2 Years Fixed

2

Years

Fixed

at

3.54%

|

|

|

|

4.49%

2 Years Fixed

2

Years

Fixed

at

4.49%

|

|

|

|

4.89%

2 Years Fixed

2

Years

Fixed

at

4.89%

|

|

|

|

4.89%

2 Years Fixed

2

Years

Fixed

at

4.89%

|

|

|

|

4.99%

5 Years Fixed

5

Years

Fixed

at

4.99%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £125000 property value, a £100000 loan amount and £25000 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

The mortgage products shown are for illustrative purposes only and were generated 15 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

🔷What are the best HMO Remortgage Rates?

The HMO Mortgage market is in constant flux with lots of competition. This means rates vary from time to time within the Loan-to-value (LTV) ranges. If you have a small HMO a minority of lenders may allow you to mortgage on standard buy-to-let rates, large HMOs may require commercial rates. Given these complexities - it's always best to talk to a specialist HMO Mortgage adviser to find the best mortgage for your needs and circumstances.

🔷What equity is needed?

The minimum HMO Mortgage equity is 15% of the property value (85% LTV). The rental amount can limit the maximum loan achievable, requiring higher equity. Landlords with more substantial deposits can enjoy better HMO Mortgage products and rates.

🔷What is an HMO remortgage?

If you intend to remortgage a property to rent it out to more than one household, you require a House of Multiple Occupancy (HMO) Mortgage. Your standard Buy to Let Mortgage contract often limits the number of households that can live in a property and limits tenants to having just one tenancy. An HMO mortgage is a different contract with a mortgage lender.

These contracts allow you to have multiple households and each of them to have their individual tenancy (if required). If your property does not require an HMO License, you can benefit from traditional Buy-to-Let rates in certain circumstances. Available from a select few mortgage lenders.

If your property requires an HMO License you will need an HMO Mortgage. You will often remortgage your HMO for one of two reasons: To obtain a better mortgage rate. To release equity by increasing borrowing.

🔷Talk to our HMO Mortgage Advisers

-

Buy-to-Let Mortgage

>

Dive into property investment with our Buy-to-Let Mortgage, tailored for both seasoned investors and first-timers seeking to build a profitable portfolio.

-

Buy-to-Let Remortgage

>

Maximize your investment with Buy-to-Let Remortgage, ensuring optimal returns by refinancing your property portfolio with competitive rates.

-

Buy-to-Let Rate Switch

>

Enhance your property investment strategy with a Buy-to-Let Rate Switch, ensuring you stay competitive in the market with a smart financial move.

-

Buy-to-Let Company Mortgage

>

Optimize your property portfolio's potential with a Buy-to-Let Mortgage in your SPV Company Name, combining strategic investments with simplified financial structures.

-

Portfolio Mortgages

>

Grow and diversify your property portfolio with our Portfolio BTL Mortgages, offering tailored solutions for seasoned investors aiming for prosperity.

-

Holiday Let Mortgage

>

Transform your vacation home investment dreams into reality with a Holiday Let Mortgage,

-

HMO Mortgage

>

Unlock the potential of shared living spaces with our HMO Mortgage, tailored to support your investment in Houses in Multiple Occupation.

-

HMO Company Mortgage

>

Elevate your HMO investment strategy with our HMO Mortgage in your SPV Company Name, combining strategic planning with streamlined financial structures.

-

HMO Remortgage

>

Revitalize and optimize your HMO investment with a strategic HMO Remortgage, ensuring your shared living spaces remain lucrative in the market.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX