Buy-to-Let Remortgage Guide

The best place to find landlord remortgage services and information Simpler, clearer, faster

Landlords Nationwide compare buy-to-let remortgage products with our mortgage advisers. You too can save money when you compare buy-to-let remortgage rates with quotes from some of the leading mortgage providers in the UK.

The rules around landlord finance may have changed since you purchased the property. Lenders have implemented new rental stress tests, portfolio-wide stress tests, minimum EPC scores and more obstacles.

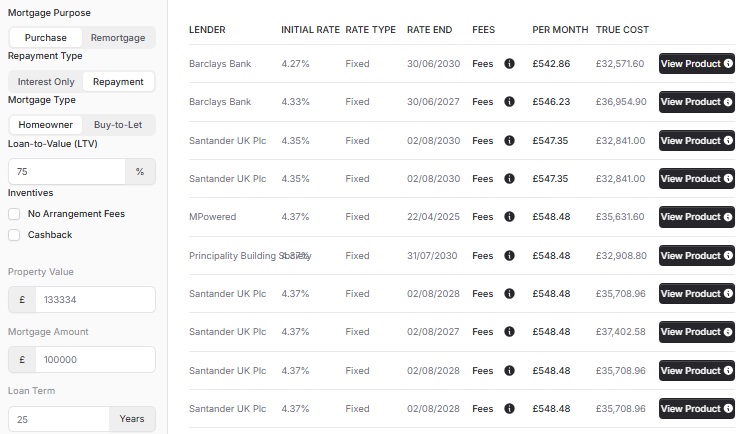

Lowest Buy-to-Let (BTL) Remortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

2.20%

2 Years Fixed

2

Years

Fixed

at

2.20%

|

|

|

|

2.25%

2 Years Fixed

2

Years

Fixed

at

2.25%

|

|

|

|

2.29%

1 Year Fixed

TBC

TBC

Fixed

at

2.29%

|

|

|

|

2.30%

2 Years Fixed

2

Years

Fixed

at

2.30%

|

|

|

|

2.35%

2 Years Fixed

2

Years

Fixed

at

2.35%

|

|

The mortgage products shown are for illustrative purposes only and were generated 24 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £142858 property value, a £100000 loan amount and £42858 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

2.20%

2 Years Fixed

2

Years

Fixed

at

2.20%

|

|

|

|

2.25%

2 Years Fixed

2

Years

Fixed

at

2.25%

|

|

|

|

2.29%

1 Year Fixed

TBC

TBC

Fixed

at

2.29%

|

|

|

|

2.30%

2 Years Fixed

2

Years

Fixed

at

2.30%

|

|

|

|

2.35%

2 Years Fixed

2

Years

Fixed

at

2.35%

|

|

The mortgage products shown are for illustrative purposes only and were generated 24 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £133334 property value, a £100000 loan amount and £33334 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

2.54%

2 Years Fixed

2

Years

Fixed

at

2.54%

|

|

|

|

2.54%

2 Years Fixed

2

Years

Fixed

at

2.54%

|

|

|

|

2.80%

2 Years Fixed

2

Years

Fixed

at

2.80%

|

|

|

|

2.80%

2 Years Fixed

2

Years

Fixed

at

2.80%

|

|

|

|

3.35%

2 Years Fixed

2

Years

Fixed

at

3.35%

|

|

The mortgage products shown are for illustrative purposes only and were generated 24 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £125000 property value, a £100000 loan amount and £25000 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.26%

2 Year Fixed

TBC

TBC

Fixed

at

5.26%

|

|

|

|

5.92%

2 Year Fixed

TBC

TBC

Fixed

at

5.92%

|

|

|

|

5.94%

5 Year Fixed

TBC

TBC

Fixed

at

5.94%

|

|

|

|

6.29%

5 Year Fixed

TBC

TBC

Fixed

at

6.29%

|

|

|

|

6.59%

5 Years Fixed

5

Years

Fixed

at

6.59%

|

|

The mortgage products shown are for illustrative purposes only and were generated 24 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

What is a buy-to-let remortgage?

You use a buy-to-let remortgage when you already own residential property but want to refinance it and rent it out.

Landlords do this when the initial mortgage term has come to an end, to release equity. Or to get better mortgage rates often moving away from the lenders higher Standard Variable Rate (SVR).

Others are homeowners who want to rent out their current residence, changing the mortgage to a type that allows renting to others.

What deposit is needed?

You often do not need any additional deposit. You will already have this in the property, now known as equity.

The house price may have increased since you purchased it, increasing the equity. Give you lower LTV remortgages or some landlords choose to release this equity (to invest in further properties, renovate, etc..).

If the house price has decreased, this has eaten away at your equity. Meaning a higher LTV remortgage may be required.

The maximum LTV for a buy-to-let remortgage is 85% of the property value (15% equity required). If your LTV is higher than this, you may not be able to remortgage without investing more money.

The rental amount can limit the maximum remortgage loan amount achievable, requiring more substantial equity investment.

Our mortgage advisors can help you look at your overall position if that is to invest further or release equity.

What about further advances, simpler?

Yes - some mortgage lenders (your existing lender) offer a further advance, allowing you to obtain a new rate and release equity from your property.

Lenders treat further advances differently - in general, it is less paperwork, but they may require a re-valuation and full application to check against current criteria.

Unfortunately, further advance products may not be as competitive as other lenders, or the lender's remortgage products themselves.

Will I pay Stamp Duty?

No - typically on a remortgage there is no stamp duty to pay. It may be different if you are changing ownership, such as removing someone from ownership of a property or bringing in someone as a joint venture.

How much are remortgage legal fees?

You have a few options when remortgaging - some lenders offer a "free legals" products. Unfortunately, these can result in higher interest rates than mortgage products without the offer.

Product Switches often do not have any legal fees to pay.

The legal fees for remortgages are often a lot lower than legal fees for purchasing though they both often depend on the value of the property. We can obtain you a quote to compare.

Can I add someone on to the mortgage when remortgaging?

Yes - You can change the ownership structure of a property owner on remortgage. There may be SDLT to consider on the part-sale of the property to another person.

Can I remove someone on the mortgage when remortgaging?

Yes - this will depend if you alone will meet the lender's criteria, without the need of the other applicant. As one person is selling their share of the property to you, there may be SDLT to consider.

Can I remortgage my buy-to-let property early?

Yes - Unfortunately some mortgages come with "Early Repayment Charges". These are often only required if you are remortgaging within the initial promotional term. Such as remortgaging six months into a 2-year fix.

Can I remortgage my buy-to-let to pay off debt?

We can help you with debt consolidation remortgages. There is a lot to consider if this is a good or bad thing given your circumstances and you should seek advice.

Can I remortgage my buy-to-let to release equity?

Yes - we can help you remortgage your buy-to-let property or portfolio to release equity for any legal means. The maximum equity can release will depend on the maximum loan to value and minimal loan caps.

Can I remortgage my buy-to-let on maternity leave?

Yes - if you plan to go back to work on a similar income. We have mortgage lenders that will consider future circumstances. Given the rental income, this will typically provide the lender with the confidence of affordability over this period.

Can I remortgage my buy-to-let when unemployed?

Yes - the rental income of your buy-to-let property is often enough to give the lender confidence. They will want similar confidence that you can maintain your lifestyle and cover potential void periods.

When I remortgage can I change the term?

Yes - We can help you remortgage and increase the mortgage term. The term of the mortgage is often limited by your age and the lender's criteria. Some mortgage lenders go up to 110 years old at the end of the term, with a minority having no age limit.

Who should not remortgage?

We can look at all situations and advice where best to proceed. We have advised clients to stay with their current lender if they are on a legacy mortgage product that is very competitive compared to today's products.

In such cases, we have also advised 2nd charges to release equity for the client to retain the existing great 1st charge deal.

-

Buy-to-Let Mortgage

>

Dive into property investment with our Buy-to-Let Mortgage, tailored for both seasoned investors and first-timers seeking to build a profitable portfolio.

-

Buy-to-Let Remortgage

>

Maximize your investment with Buy-to-Let Remortgage, ensuring optimal returns by refinancing your property portfolio with competitive rates.

-

Buy-to-Let Rate Switch

>

Enhance your property investment strategy with a Buy-to-Let Rate Switch, ensuring you stay competitive in the market with a smart financial move.

-

Buy-to-Let Company Mortgage

>

Optimize your property portfolio's potential with a Buy-to-Let Mortgage in your SPV Company Name, combining strategic investments with simplified financial structures.

-

Portfolio Mortgages

>

Grow and diversify your property portfolio with our Portfolio BTL Mortgages, offering tailored solutions for seasoned investors aiming for prosperity.

-

Holiday Let Mortgage

>

Transform your vacation home investment dreams into reality with a Holiday Let Mortgage,

-

HMO Mortgage

>

Unlock the potential of shared living spaces with our HMO Mortgage, tailored to support your investment in Houses in Multiple Occupation.

-

HMO Company Mortgage

>

Elevate your HMO investment strategy with our HMO Mortgage in your SPV Company Name, combining strategic planning with streamlined financial structures.

-

HMO Remortgage

>

Revitalize and optimize your HMO investment with a strategic HMO Remortgage, ensuring your shared living spaces remain lucrative in the market.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX